Be aware! Be diligent!

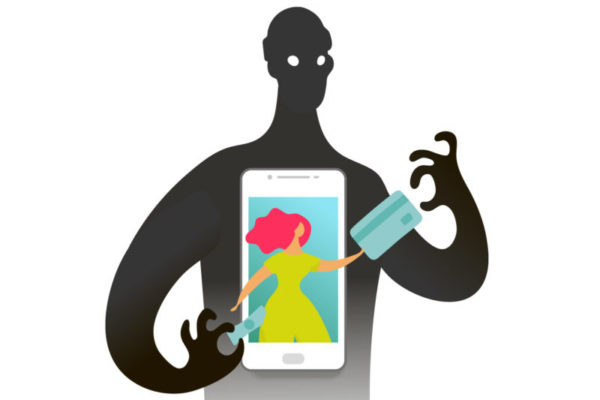

Are you aware of some the latest and creative ways scammers are taking advantage of the public during the pandemic? Their intent is simple, to obtain your account information and use that information for fraudulent activity or to take your money. Scary stuff!

Please take a moment to familiarize yourself with some of the latest scams CPM Federal Credit Union has been monitoring. Remember CPM, will never contact you and ask you for your account information.

CASH APP: This is the latest in the scam schemes to circulate throughout the country. Scammers use social media outlets like Facebook or online dating sites to target transaction mules asking if they would like to make “quick money”. The scammer will ask for your Cash App information then use this to make fraudulent deposits such as an unemployment claim that was filed in someone else’s name or possibly even your name. The scammer will ask to receive a portion of the funds in cash or by other means.

Scammers can also obtain your Cash App information by luring you in using a fake celebrity profile and cash winning contests.

Never provide your account information or credentials to your bank account or other payment tools. Learn more

Fake Testing Sites: It’s hard to believe but it’s true. Scammers will set up fake testing sites with signage, tents and professional looking “testers”. The purpose is to obtain your personal information. Do your homework before going to a mobile testing site. Learn more

COVID-19 Text Scams: The new buzz word in all press conferences is Contact Tracers. It’s the process of identifying people who have come in contact with someone who has tested positive for COVID-19, instructing them to quarantine and monitoring their symptoms daily.

Scammers are taking advantage of this new outreach effort and sending fake text messages asking you to click a link. Don’t fall for it! Clicking on the link will download software onto your device, giving scammers access to your personal and financial information. Ignore and delete these scam messages. Contact tracers will only text you letting you know someone will be contacting you. Learn more about some additional steps for prevention.

Robocall Scams: Scammers are using robocalls to impersonate agencies such as the Social Security Administration to get your account information, social security number or other personal information. Remember CPM, the IRS, or other agency such as Social Security Administration would not contact you asking you for information. Hang up!

Product scams: Masks and paper products like toilet paper are in high demand. Scammers are taking advantage of this need and you guessed it, selling products that never show up! Consumers are purchasing products online and when the products never arrive inquiries go unanswered. Do your homework before you purchase. Read more

In this time of fear and uncertainty, it’s important to remain diligent and educated! Monitor your account regularly and set up transactional alerts so you react quickly should a scammer obtain your account information. Need help setting up an alert? Give us a call at 800.255.1513 and we woud be happy to walk you through the process. Don’t have CPM Online or Mobile Banking? No problem, call us to get set up.

Stay informed by visiting ftc.gov